From Marlboro to Machine Learning: The Business Pivot That Saved the Scuderia

- CT

- Dec 3, 2025

- 9 min read

Updated: Dec 7, 2025

The Intersection of Heritage and High Finance

In the high-stakes theater of the Formula One World Championship, Scuderia Ferrari stands as the protagonist around which the sport’s history revolves. As the only team to have competed in every season since the championship’s inception in 1950, the "Prancing Horse" represents a unique synthesis of national identity, automotive luxury, and racing pedigree (Scuderia Ferrari, 2024). However, the narrative of Ferrari’s success—spanning 16 Constructors’ Championships and 15 Drivers’ titles—is not merely a story of Italian mechanical engineering. It is a complex case study in strategic partnership management.

Ferrari’s dominance, particularly during the golden era of the early 2000s, and its current resurgence, are underpinned by a sophisticated network of commercial and technical alliances. This ecosystem has evolved from simple sticker placements to deep, embedded engineering collaborations. In the modern era, where financial regulations cap spending, the competitive advantage has shifted from raw purchasing power to "Value-in-Kind" (VIK) efficiency, where partners like AWS, Palantir, and HP provide the digital infrastructure necessary to circumvent resource limitations.

This analysis dissects the commercial and technical engines that drive Scuderia Ferrari, examining how tobacco capital funded an era of unlimited testing, how chemical engineers contribute to lap times, and how data analytics firms are reshaping race strategy in the budget cap era.

The Pre-Commercial Era and the Fiat Acquisition (1950–1970s)

Enzo Ferrari famously declared, "I have, in fact, no interest in life outside racing cars," viewing his road car production merely as a financial necessity to fund the Scuderia. In the championship's nascence, the concept of commercial sponsorship was alien; teams raced in national colors, with Ferrari clad in the iconic Rosso Corsa assigned to Italy. During this period, support came from "technical partners" rather than commercial sponsors. Shell, for instance, has partnered with the team since the very first Formula One World Championship season in 1950, providing fuel and lubricants in exchange for technical validation rather than billboard-style advertising.

The escalating costs of the 1960s, however, pushed this model to its breaking point. In 1963, Enzo Ferrari entered advanced negotiations to sell the company to Ford. The deal famously collapsed at the eleventh hour when Enzo realized he would lose autonomous control over the racing budget and operations. The tension between financial survival and political independence peaked in 1964. Following a dispute with the Italian motorsport authority (ACI) over the homologation of the 250 LM, a furious Enzo handed back his competition license. In a dramatic act of protest, the Scuderia competed in the final two races of the 1964 season—including John Surtees’ title-winning race in Mexico—under the banner of the North American Racing Team (NART), painting the cars in American blue and white instead of Ferrari red.

Stability was finally secured in 1969 through a landmark agreement with Fiat. Unlike the Ford proposition, this deal allowed Enzo Ferrari to retain 100% control of the Gestione Sportiva (racing division) while Fiat acquired 50% of the road car business. The terms were highly favorable: Fiat committed to a non-repayable contribution of 250 million lire annually for five years and transferred all of Lancia’s racing assets to Maranello to bolster the team. While the FIA opened the floodgates to commercial sponsorship in 1968—leading rivals like Lotus to adopt cigarette liveries immediately—Ferrari resisted pure commercialization for nearly another decade. It was not until 1977, on the 312T2, that the Fiat logo first appeared prominently on the car, signaling the end of the unbranded era.

The Commercial Engine: The Philip Morris Paradigm

For over four decades, the financial bedrock of Scuderia Ferrari has been its controversial yet lucrative partnership with Philip Morris International (PMI). While tobacco sponsorship was ubiquitous in motorsport during the late 20th century, the relationship between Ferrari and the maker of Marlboro evolved into a business model that fundamentally altered the team's trajectory.

The Era of Unlimited Resources

The partnership, which began in 1973/1984 depending on the scope of integration, eventually saw PMI become the Title Sponsor in 1997 (sportspro.com, June 2011). This alliance provided the capital required to fuel the "Schumacher Era" (2000–2004). During this period, the team operated with budgets estimated between $300 million and $440 million, figures that allowed for unlimited private testing at the Fiorano circuit (F1metrics.wordpress.com, May 2015).

By 2010, even after the banning of explicit tobacco advertising on cars, the partnership remained worth an estimated $100 million+ annually. This capital was critical not just for hardware, but for personnel, allowing Ferrari to retain top-tier talent like Michael Schumacher, Ross Brawn, and Jean Todt.

Regulatory Evasion and "Mission Winnow"

As global regulations tightened, the partnership adapted. Following the ban on tobacco branding, the team utilized a "barcode" livery, which critics argued was subliminal advertising designed to blur into a recognizable logo at high speeds (The Wall Street Journal, May 2010). In 2018, PMI launched "Mission Winnow," an initiative described as encapsulating “our commitment to strive for better in everything we do. To winnow, or to discard old approaches, is what we at PMI are doing—we take learnings from past mistakes to shape our future.” (Philip Morris International, May 2019).

Despite the removal of Mission Winnow branding at certain races due to local health regulations, the financial pipeline remained intact. The integration ran so deep that Maurizio Arrivabene, a former Vice President of Marlboro Global Communication, was appointed Team Principal of Scuderia Ferrari in 2014, highlighting the blurred lines between sponsor and team management (thegentlemanracer.com, November 2014).

The Technical Engine: Engineering Horsepower

While the commercial engine provided the funds, the technical engine converted that capital into on-track performance. Ferrari’s most enduring technical partnerships—specifically with Shell, Bridgestone, and Brembo—demonstrate how external suppliers function as extensions of the design office.

Shell: The 21% Efficiency Gain

The partnership with Shell, dating back to the 1920s and solidified in the modern F1 era, is arguably the most critical technical alliance for the Power Unit. In the current V6 Turbo-Hybrid era, fuel and lubricants are performance differentiators, not commodities.

Data reveals the staggering impact of this collaboration: Shell’s specialized fuels and lubricants contributed to 21% of Ferrari’s total power unit performance gain during the 2018 season (Energy Digital, October 2024). This is achieved through friction reduction; Shell engineers develop ultra-low-viscosity lubricants that protect the engine at 15,000 RPM while minimizing parasitic loss.

Furthermore, Shell maintains a trackside laboratory staffed by at least two scientists at every Grand Prix (Shell, May 2024). These engineers analyze oil samples to detect trace metals, allowing them to predict component failures before they appear on telemetry—a vital capability in an era where teams are limited to a handful of engines per season.

Bridgestone: The "Tire War" Advantage

During the tire war of the early 2000s, Ferrari’s relationship with Bridgestone was a decisive factor in their dominance. While rival manufacturer Michelin supplied nearly half the grid, Bridgestone focused its development almost exclusively on Ferrari’s chassis characteristics (F1Chronicle, October 2025).

This allowed Ferrari to run strategies that were impossible for their rivals. For instance, Michael Schumacher’s ability to execute a four-stop strategy to win the 2004 French Grand Prix was predicated on bespoke tires that could deliver qualifying-pace laps over short stints (formula1.com, April 2020). The symbiotic relationship meant the car suspension was designed around the tire, and the tire was constructed around the car, creating a closed-loop performance advantage that ended only when regulations mandated a single tire supplier.

Brembo: Deceleration Technology

Ferrari’s partnership with Brembo, which began in 1975, has evolved into a critical component of the car’s energy recovery system (Brembo). Modern F1 braking is not just about stopping; it is about "Brake-by-Wire" (BBW) integration.

Brembo supplies the hydraulic master cylinders and BBW units that manage the interplay between physical carbon discs and the MGU-K (electric motor) regenerative braking. The customization is extreme: Brembo carbon discs have evolved from having 72 ventilation holes in the early 2000s to over 1,400 holes today to manage temperatures exceeding 1,000°C (Brembo). This thermal management is essential not just for reliability, but for generating tire temperature to activate grip during qualifying laps.

SKF and Mahle: The Micro-Advantages

The quest for efficiency extends to the smallest components.

SKF Bearings: Swedish partner SKF supplies ceramic needle bearings for the Ferrari gearbox. SKF data indicates that these ceramic components reduce friction by nearly 70% compared to standard steel bearings, directly transferring more horsepower to the wheels (SKF Evolution, April 2023).

Mahle Pistons: German engineering firm Mahle supplies high-strength forged aluminum pistons. These components are engineered to withstand the immense pressures of the combustion chamber while remaining lightweight to reduce reciprocating mass, allowing for faster engine response (Ferrari Magazine, July 2018).

The Digital Revolution: Data as the New Fuel

As the FIA introduced strict limits on physical testing and wind tunnel hours, the battlefield shifted to the virtual domain. Ferrari’s recent partnerships reflect a pivot toward digital engineering, cloud computing, and artificial intelligence.

Palantir Technologies: The Digital Twin

Since 2016, Ferrari has utilized Palantir Technologies' Foundry platform to manage the massive influx of data generated by the cars. The Power Unit department uses Palantir to “optimize performance, and rapidly analyze data from sources such as Grand Prix data, test bench results, and part information” (Palantir Press Release, February 2022).

This system allows for rapid reliability analysis. If a part fails on the dyno, engineers can instantly trace the batch of that specific component to see if it is installed in a race engine, allowing for preemptive replacement. Former Team Principal Mattia Binotto noted that tasks which previously took minutes of calculation can now be executed in seconds, speeding up decision-making during critical race windows (Palantir Press Release, February 2022).

AWS: Machine Learning and Strategy

The partnership with Amazon Web Services (AWS) focuses on leveraging cloud computing and machine learning (ML) to optimize race strategy and pit stops. Ferrari uses AWS SageMaker to analyze pit stop performance. The system utilizes ML to synchronize video footage with telemetry, automatically detecting micro-delays in wheel gun engagement. This automation reduced the analysis time by 80%, allowing the pit crew to run more practice cycles and refine their technique (AWS Blog, May 2025

HP: The Return of the Title Sponsor

In 2024, Ferrari announced a historic title partnership with HP, rebranding the team as Scuderia Ferrari HP. This deal, comparable in scale to Red Bull’s alliance with Oracle (estimated at ~$100 million annually), provides both capital and hardware (RacingNews365, January 2025).

Beyond branding, HP supplies adaptive PCs and printing technology. This capability allows Ferrari to rapid-prototype parts at the track, reacting to aerodynamic data in real-time to print and test small components during a race weekend—a massive advantage in the rapid-development war of modern F1 (Ferrari Press Release, April 2024).

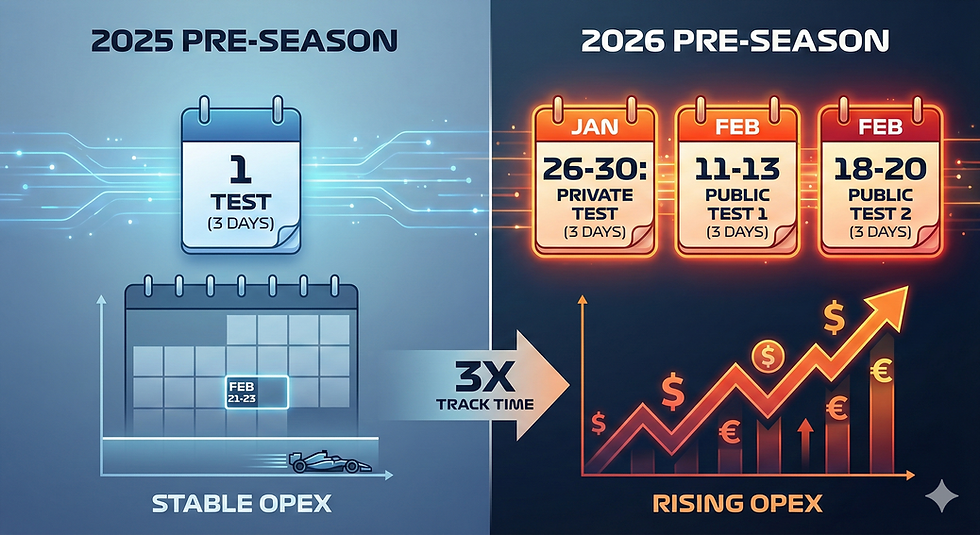

Efficiency in the Budget Cap Era

The introduction of the budget cap in 2021 (set at $135 million for 2023) fundamentally changed the economics of F1 (gotothegrid.com, April 2025). In the past, Ferrari could simply outspend rivals; today, they must out-efficient them.

Sponsorship Revenue and Valuation

Ferrari remains the commercially strongest team on the grid. Forbes estimates the team’s valuation at $3.9 billion, with annual revenues of $680 million (RTR Sports, January 2025). The addition of HP as a title sponsor and the high-value renewal with Puma (elevated to Premium Partner in 2024) ensure that Ferrari operates at the cap ceiling while having ample resources for excluded costs like driver salaries and marketing (Ferrari Corporate, September 2023).

The "Value-in-Kind" (VIK) Shift

With a hard cap on spending, partners who provide technology (VIK) are increasingly valuable. A cash sponsor provides money that, when spent, counts against the cap. A technical partner like HCL Software or Genesys provides software tools that improve efficiency—effectively allowing the team to do more work per dollar spent.

Genesys: Helps Ferrari tailor customer and fan interactions using AI, enhancing the brand's digital ecosystem (Ferrari Corporate, October 2024).

HCL Software: Provides Volt MX and AppScan solutions implemented by Ferrari to enhance employee experience and security by accelerating their digital journey (HCL Software, May 2023).

The Banking Pivot: Santander to UniCredit

A major shift in the financial partner landscape occurred in 2024. Ferrari announced the termination of its partnership with Spanish bank Santander, effective December 31, 2024 (finance.yahoo.com, August 2024). Almost immediately, the team announced a new multi-year premium partnership with UniCredit, a leading pan-European bank, starting January 1, 2025 (Ferrari Press Release, January 2025). This move aligns the team with a major Italian financial institution, reinforcing the national identity of the Scuderia as it prepares for the next regulatory cycle.

The Synthesis of Success

The history of Scuderia Ferrari is a testament to the power of strategic synthesis. The team's most successful periods have occurred not in isolation, but when Maranello successfully integrated the financial might of partners like Philip Morris and HP with the technical expertise of Shell, Brembo, and Palantir.

As the team heads toward the 2026 regulatory reset, the pieces are in place for a new era of competitiveness. The "Commercial Engine" is fully fueled by the HP title deal ensuring maximum budgetary headroom. The "Technical Engine" is optimized through AI-driven reliability (Palantir/AWS) and sustainable fuel development (Shell).

In the modern Formula One landscape, a team cannot win on heritage alone. Ferrari’s ability to reclaim the championship will depend on how effectively it continues to leverage this global coalition of partners, turning dollars and data into the only currency that ultimately matters: lap time.

Comments