The Renaissance of Digital Assets in Motorsport: Crypto Sponsorship Maturity in Formula One (2023–2025)

- CT

- Nov 26, 2025

- 11 min read

The commercial landscape of Formula One (F1) has historically served as a barometer for global economic trends, shifting from tobacco giants in the 1990s to telecommunications, and more recently, to the burgeoning sector of digital assets. The intersection of elite motorsport and the cryptocurrency industry has undergone a radical and often volatile transformation in the years following the catastrophic collapse of the FTX exchange in late 2022. Once characterized by speculative exuberance, opaque financial structures, and fragile partnerships focused solely on brand awareness, the landscape has matured into a sophisticated ecosystem of strategic technical integrations, verified financial utility, and high-fidelity fan engagement.

This article provides a comprehensive analysis of the resurgence of crypto sponsorships in F1, detailing the economic rebound that has seen sponsorship valuations from the fintech and crypto sectors exceed $1 billion over the 2021–2025 period, with a record $273.6 million committed in the 2025 season alone (Fintechnews.ch, 2025). We examine how the focus has shifted from mere decal placement to deep technical partnerships, where blockchain technology is utilized for data security, supply chain management, and next-generation loyalty programs.

Through detailed case studies of key partnerships—including Red Bull Racing’s bifurcation of financial and technical partners, McLaren’s gamified digital collectibles with OKX, and Aston Martin’s pioneering use of USDC for sponsorship settlements—this article illuminates the mutual value exchange that defines the current era.

The Evolution of Commercial Partnerships in Formula One

The Historical Context of F1 Sponsorship

Formula One is often described not merely as a sport, but as a traveling global billboard for the world’s most ambitious industries. To understand the current resurgence of crypto sponsorships, one must contextualize it within the historical arc of F1 financing. For decades, the sport was fueled by the tobacco industry, which provided immense liquidity but offered little in terms of technological transfer. Following the ban on tobacco advertising, the grid saw an influx of telecommunications and banking sponsors, entities that sought to associate their services with the speed and reliability of F1 engineering.

The entry of the cryptocurrency sector circa 2019 represented a new paradigm. Unlike banks or telecom providers, crypto firms were not just seeking brand association; they were seeking legitimacy. In an industry plagued by skepticism and regulatory ambiguity, placing a logo on a Mercedes or a Ferrari served as a proxy for due diligence, signaling to retail investors that these platforms were solvent and trustworthy. However, this reliance on marketing-as-legitimacy proved catastrophic when the underlying financials of major players crumbled, leading to the "Crypto Winter" of 2022.

The Post-FTX Watershed

The collapse of FTX in November 2022 was the single most defining moment for the modern F1 commercial landscape. FTX had aggressively pursued sports sponsorships, signing a lucrative deal with the Mercedes-AMG Petronas F1 Team that was abruptly terminated upon the exchange’s bankruptcy filing (Ledger Insights, 2022). The shockwaves were felt immediately across the paddock. Team Principal Toto Wolff expressed "disbelief" at the speed of the unraveling, noting that despite vetting, the volatility of the sector exposed the team to significant reputational risk (Pitpass, 2022).

This event triggered a "cleansing" of the grid. It was not just Mercedes that suffered; the contagion effect led to the dissolution of Ferrari’s partnership with Velas and Red Bull’s agreement with Tezos (TradingView, 2023; BlackBook Motorsport, 2022). The prevailing narrative in late 2022 was that crypto’s dalliance with F1 was over. Yet, as this article details, the opposite has occurred. The exit of speculative actors cleared the way for established, regulated, and technically proficient players to enter the sport, driving a resurgence that is characterized by maturity rather than mania.

The Anatomy of the Crisis: The 2022-2023 "Crypto Winter"

To appreciate the maturity of the current landscape, one must first dissect the failures that necessitated it. The period between late 2022 and early 2023 saw the termination of high-profile deals worth hundreds of millions of dollars, creating a temporary liquidity vacuum and forcing teams to fundamentally re-evaluate their due diligence processes.

Mercedes-AMG Petronas and the FTX Fallout

The partnership between Mercedes and FTX was emblematic of the pre-crash era: high value, high visibility, and ultimately, high risk. The deal, signed in September 2021, involved prominent branding on the car and race suits (BlackBook Motorsport, 2022). When FTX filed for Chapter 11 bankruptcy, Mercedes was forced to suspend the agreement immediately, removing branding ahead of the Brazilian Grand Prix (AP News, 2022).

The collapse humiliated a team that prides itself on corporate excellence. Toto Wolff’s public comments highlighted a critical vulnerability: traditional due diligence was insufficient for analyzing the opaque balance sheets of offshore crypto exchanges. Wolff admitted while they considered FTX "one of the most credible and solid, financially sound partners that were out there," the sector’s lack of regulation made it inherently unpredictable (Pit Pass, 2022). This experience led Mercedes to retreat from the sector temporarily, focusing on more traditional technology partners like SAP and WhatsApp in 2024 (Formularapida.net, 2024), effectively sitting out the initial phase of the resurgence to avoid further reputational contagion.

Scuderia Ferrari and Velas: The Breach of Contract

While the FTX case was one of insolvency, the Ferrari-Velas split was a case of operational failure and legal dispute. Velas, a blockchain network, had signed a premium partnership with Ferrari worth an estimated $30 million annually. However, in early 2023, the deal was terminated amid mutual accusations of breach of contract (BlackBook Motorsport, 2023).

Reports indicated that Ferrari did not comply with clauses permitting Velas to create NFT images, likely due to hesitation regarding the brand’s intellectual property protection in the Web3 space. Conversely, Velas was accused of financial non-compliance (RacingNews365, 2023). This dispute highlighted a second failure mode of the era: the misalignment between the conservative IP protection strategies of heritage luxury brands and the "move fast and break things" culture of Web3 startups. The resulting $55 million hole in Ferrari’s budget (combined with the loss of Snapdragon) forced the team to aggressively seek new partners (RacingNews365, 2023).

Red Bull Racing and Tezos: Strategic Misalignment

Red Bull Racing’s termination of its deal with Tezos in late 2022 was less dramatic but equally instructive. Tezos had been signed as the team’s "Official Blockchain Partner" to build an NFT experience. The decision to part ways was reportedly driven by a misalignment on strategy and the broader market downturn, which rendered the initial value propositions of the deal obsolete (BlackBook Motorsport, 2022; Sports Business Journal, 2022). This marked the end of "Blockchain Partnerships" that were purely marketing exercises, paving the way for the technical integration Red Bull would later pursue with Sui.

The Resurgence: Quantitative Analysis of the 2024–2025 Market

Contrary to the "death of crypto sponsorship" narrative, the sector has rebounded stongly. The years 2024 and 2025 have witnessed not just a return to spending, but an expansion of the sector’s footprint in F1, driven by survivorship bias—the companies that survived the winter are stronger, better capitalized, and more regulated.

Record-Breaking Investment Levels

According to research by BitOK, cryptocurrency and fintech sponsorships in F1 reached a record $273.6 million in the 2025 season, distributed across 21 distinct partners (Fintechnews.ch, 2025). This represents a robust recovery trajectory:

2024: 15 partnerships worth ~$251 million.

2025: 21 partnerships worth ~$273.6 million (+9% value YoY, +40% volume YoY).

The total estimated sponsorship spending by fintech and crypto brands from 2021 to 2025 has now exceeded $1 billion (Fintechnews.ch, 2025). This sustained level of investment indicates that F1 remains the premier global platform for these companies to acquire users and build brand equity.

The Shift to Institutional Players

The composition of the sponsors has shifted. In 2021, the market was populated by varied token projects and newer exchanges. By 2025, the landscape is dominated by established giants and regulated entities:

Crypto.com: Extended its Global Partnership with F1 through 2030, cementing its status as a "pillar" sponsor alongside Rolex and Aramco (Formula1.com, 2024).

Coinbase: Entered the sport via Aston Martin, bringing the credibility of a publicly traded (NASDAQ: COIN) US company (Aston Martin F1, 2025).

Kraken: Deepened its integration with Williams Racing, focusing on the Grid Pass digital collectible program (Williams Racing, 2024).

OKX: Expanded its deal with McLaren to become a "Primary Partner," dominating the car’s livery (McLaren, 2024).

Team | Partner | Category | Estimated Annual Value |

Red Bull Racing | Sui (Mysten Labs) | Blockchain L1 | ~$5M+ |

McLaren | OKX | Exchange/Wallet | ~$35M+ |

Williams Racing | Kraken | Exchange | ~$15M |

Aston Martin | Global Partner | N/A (F1 Deal) | |

Aston Martin | Coinbase | Exchange | Undisclosed |

Alpine | Binance | Exchange | ~$4M |

Alpine | ApeCoin DAO | DAO/Token | ~$2.7M (€5.1M/2yr) |

Sauber | Stake | Casino/Crypto | $40M (Title) |

Source: Compiled from BitOK, Sportcal, BlackBook Motorsport, and team press releases.

Team Case Study: Red Bull Racing – The Bifurcated Strategy

Red Bull Racing (RBR) exemplifies the mature approach to crypto sponsorship by separating the commercial extraction of value from the technical application of the technology. Rather than bundling everything into one deal, RBR pursued two distinct paths: a high-value exchange sponsorship for revenue (Bybit) and a specialized blockchain partnership for tech (Sui).

The Commercial Engine: Bybit (2022–2024)

The partnership with Bybit, signed in early 2022, was a landmark deal valued at $150 million over three years ($50 million per annum) (Finance Magnates, 2025). At the time, it was the single largest annual crypto sponsorship in international sport.

Role: Bybit served as the "Principal Team Partner," a tier offering visibility on the car’s front and rear wings.

The Exit: The non-renewal of the Bybit deal for the 2025 season signals the volatility of exchange-based partnerships. Reports suggest that while terms were discussed, an agreement could not be reached (RacingNews365, 2025). Factors likely included Bybit’s shifting marketing priorities and regulatory pressures in specific markets like Malaysia, where the exchange was ordered to cease operations (Finance Magnates, 2025). This exit forced RBR to diversify its portfolio, bringing in partners like AvaTrade (BlackBook Motorsport, 2025).

The Technical Engine: Sui and Mysten Labs

While the Bybit deal was purely transactional, RBR’s partnership with Mysten Labs (creators of the Sui blockchain) is deeply integrated into the team’s technology stack.

Selection Process: RBR conducted an "extensive market analysis" to find a blockchain capable of matching the high-performance standards of F1. They selected Sui, a Layer 1 blockchain, for its throughput and low latency (Sui Blog, 2023).

Value Proposition: For RBR, this allows them to engage fans with technology that feels as advanced as the car itself. For Mysten Labs, it serves as a global proof-of-concept that their blockchain can handle the traffic and data intensity of a major sports property.

Team Case Study: McLaren Racing – The Gamification of Loyalty

McLaren Racing, led by CEO Zak Brown, has executed perhaps the most culturally resonant crypto strategy on the grid. By partnering with OKX, McLaren moved beyond static branding to create a gamified loyalty ecosystem that incentivizes daily engagement.

The "Primary Partner" Evolution

OKX serves as a "Primary Partner" of the team, a designation that has seen their branding dominate the sidepods of McLaren’s cars.

Livery Innovation: McLaren and OKX have utilized the "livery reveal" as a powerful marketing tool. The "Stealth Mode" livery (Singapore/Japan 2023) and the "Legend Reborn" campaign (Senna tribute) were co-branded moments that generated millions of dollars in media value. These campaigns were designed to be "future-facing," aligning McLaren’s resurgence on track with OKX’s positioning as a Web3 leader (McLaren, 2024).

The "Race Rewind" Digital Collectible Ecosystem

The crown jewel of the partnership is the "Race Rewind" program, a free-to-mint digital collectible series that runs throughout the season.

Mechanism: After every Grand Prix, fans can mint a unique digital collectible via the OKX Wallet. The "minting period" is strictly limited (Friday to Monday), creating urgency (McLaren, 2024).

Dynamic Rarity: On the Tuesday following the race, the collectibles are revealed, with rarity tiers (Classic, Rare, Ultra-Rare) assigned algorithmically. This introduces a "loot box" mechanic that drives excitement and social sharing (McLaren, 2024).

Tangible Utility: Unlike early NFTs which were often useless JPEGs, these assets have "utility vectors."

VIP Experiences: Fans who collect the full season set are eligible for prizes such as a VIP McLaren Fan Experience in Abu Dhabi, trackside hot laps, and signed merchandise (McLaren, 2024).

Token-Gated Access: Ownership of specific collectibles grants access to virtual driver briefings and exclusive content, effectively creating a tiered membership club verified by the blockchain (McLaren, 2024).

Technical Infrastructure: The X Layer

Crucially, these collectibles are minted on OKX’s proprietary X Layer blockchain.

Why X Layer? This Layer 2 solution utilizes zk-SNARK technology (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) to compress transaction data. This results in negligible gas fees and a low carbon footprint, addressing two major barriers to entry for mainstream fans (McLaren, 2024).

Strategic Goal: This is a user acquisition strategy. To participate, a fan must download and use the OKX Wallet. By offering the NFT for free, OKX dramatically lowers the Cost Per Acquisition (CPA) for new wallet users, converting passive F1 viewers into active Web3 participants (OKX, 2024).

Team Case Study: Aston Martin – The Financialization of Sponsorship

Aston Martin Aramco Formula One Team has pioneered the use of cryptocurrency as a functional financial instrument within the sport, moving beyond marketing into treasury management.

Coinbase and the USDC Revolution

In February 2025, Aston Martin announced a partnership with Coinbase, the largest US-based exchange. The critical detail of this deal is that the sponsorship is paid entirely in USDC (USD Coin) (Aston Martin F1, 2025).

What is USDC? USDC is a stablecoin pegged 1:1 to the US Dollar, issued by Circle and backed by reserved assets. It offers the speed of crypto with the stability of fiat currency.

Financial Implications: Traditional international sponsorship payments involve SWIFT transfers, currency conversion fees, and multi-day settlement times. By accepting USDC, Aston Martin receives funds almost instantly with minimal transaction costs.

Strategic Signal: Jefferson Slack, the team’s Managing Director, stated that this decision signals a commitment to "innovation" and building a "forward-thinking relationship" (Payment Expert, 2025). It serves as a proof-of-concept for other global businesses: if an F1 team can manage its cash flow in stablecoins, the technology is ready for enterprise adoption.

Crypto.com: The Global Anchor

While Coinbase handles the transactional innovation, Aston Martin’s branding landscape is heavily influenced by Crypto.com, the Global Partner of F1.

The Miami GP: Crypto.com holds the title rights to the Miami Grand Prix ("Formula 1 Crypto.com Miami Grand Prix") in a nine-year deal (F1 Miami GP, 2022). This ensures that regardless of individual team deals, the crypto brand is omnipresent at one of the most commercially significant races on the calendar.

Longevity: The extension of this partnership to 2030 provides a layer of stability to the entire F1 crypto ecosystem, reassuring other teams that the sport’s commercial rights holder (Liberty Media) remains committed to the sector (Formula1.com, 2024).

The Economics of Partnership: Value Exchange Analysis

To understand the durability of these partnerships, we must analyze the "Value Exchange"—what exactly does each side get?

What the Teams Get

Revenue Diversification: In the cost-cap era, pure cash is king. The $273.6 million influx allows teams to fund non-cap expenses (marketing, facilities, top driver salaries) while maxing out the car development budget. Crypto sponsors have effectively replaced the tobacco money of the 90s.

Youth Demographics: The average F1 fan is aging; the average crypto user is young and digital-native. Partners like OKX and Kraken provide a bridge to Gen Z, helping teams modernize their brand appeal.

Technological Upgrades: Partners like Sui and Coinbase provide actual infrastructure (cloud compute optimization, payment rails) that improves operational efficiency, rather than just providing cash.

What the Sponsors Get

Institutional Legitimacy: This is the primary commodity. By partnering with a team like Williams (founded 1977) or a brand like Aston Martin, a crypto exchange borrows the institutional trust of the sport. It signals to regulators and investors: "We are solvent enough to pay $20M a year to an F1 team."

Cost Per Acquisition Reduction: Acquiring a user via a generic Facebook ad is expensive. Acquiring a user by offering them a free McLaren Collectible (which requires a wallet download) is significantly cheaper and yields a more engaged user.

Global Licensing Workaround: F1 is a global broadcast. A car carrying a crypto logo in Bahrain is seen by millions in countries where crypto advertising might be restricted on local TV. It is a loophole for global brand reach.

Conclusion

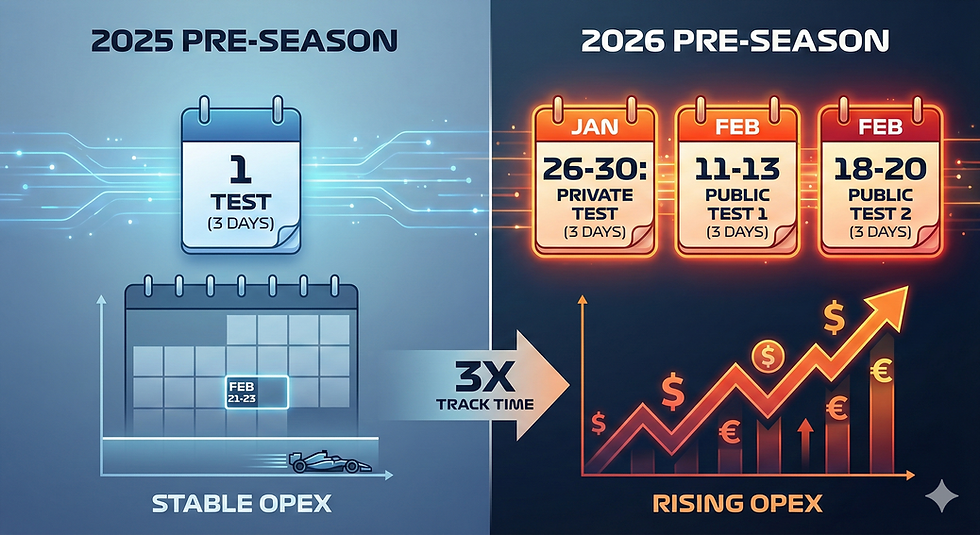

As we look toward the 2026 regulations, the convergence of Artificial Intelligence and Blockchain will help define the next phase. Companies like Globant are already integrating AI into the pit wall (Globant, 2024). The role of blockchain will be to verify the data that feeds these AI models, ensuring "Explainable AI" in race strategy.

The "Crypto Winter" did not kill the industry’s involvement in Formula One; it professionalized it. The post-FTX era is defined by a flight to quality. Sponsorships are no longer vanity projects for unicorn startups but strategic alliances for institutional financial platforms.

The relationship has deepened from surface-level branding to root-level integration. Teams are using blockchain for CRM (Williams), finance (Aston Martin), and fan loyalty (McLaren). The sponsors are using teams for product validation and user acquisition. In 2025, F1 teams and crypto sponsors have found a sustainable equilibrium: a partnership model that values utility over hype, and infrastructure over speculation. The resurgence is real, and unlike the bubble of 2021, it is built to last.

Comments